BHP $39B Bid for Anglo American

Resources M&A is back! And it's good for our names.

I wrote a (paywalled) post yesterday about supply and demand in the natural resources markets. Last night after the close, BHP announced an unsolicited bid for Anglo American, one of the world’s largest copper miners at a 31 percent premium to the closing price.

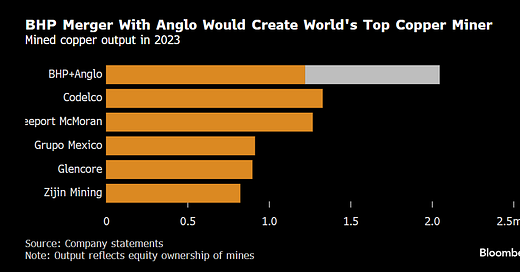

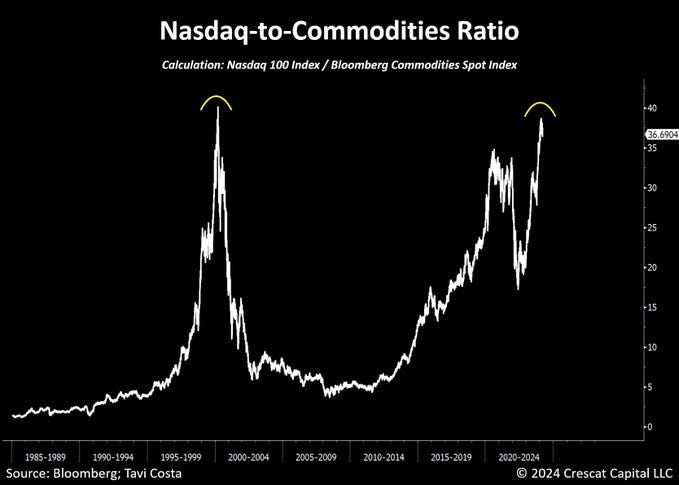

The combined firms would create the world’s biggest copper miner, by far, with about 10 percent of global production.

Chart 1: 2023 Copper Mining Output by Firm

Chart 1, above, shows just how big the BHP + Anglo firm would be in terms of copper production.

A Vote for the Green New Deal

Make no mistake about it, this is a massive bet on the Green New Deal and the electrification of everything, as well as rebuilding the electricity grid.

However, the “green” that BHP is chasing is of a different sort. Yep, the tree-hugging communists at BHP are after profit. They see exactly what I wrote about yesterday: copper supply constrained by low prices for a decade and a lack of new mines due to environmental regulations and water shortages (something I forgot to mention, but know well); compared to demand increases for as far as the eye can see.

With that setup, you want to own as much of the supply side as possible.

However, this deal will NOT increase supply, indeed, it could decrease supply in the short run, as BHP could idle any inefficient mines if it could meet demand with more efficient ones.

Copper is up two percent as I write this, so maybe the market sees the same thing.

Technology v. Commodities

Meta reported awful earnings last night and is down over 15 percent in the pre-market, same with IBM, which is down about nine percent pre-market.

I see trouble ahead for technology stocks as stretched valuations meet higher interest rates and anti-trust litigation in the U.S. and EU. All these huge names should be broken up, and likely will be.

I’m not anti-tech, I’m anti-monopoly. If DOJ hadn’t gone after Microsoft, we would all still be using Internet Explorer and Google never would have made it. (If you’re old enough to remember Clippy, you know the living hell I am describing.)

Why shift gears to talk about these sleek, sexy, businesses, when I was focused on the filthy, sun-baked, and dusty part of the global economy? To set up this chart.

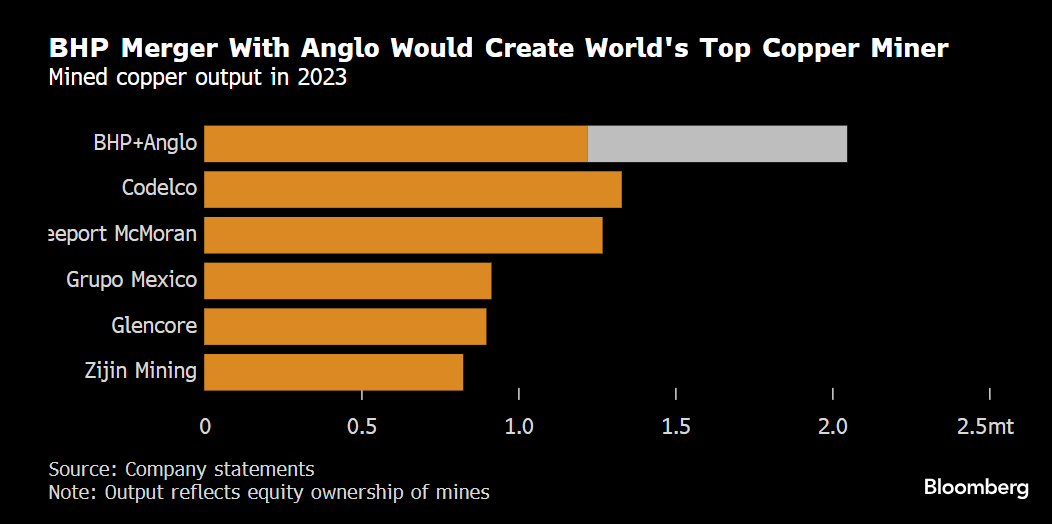

Chart 2: Nasdaq to Commodities

As Chart 2, above, clearly shows, we’ve reached an inflection point only once equaled - during the tech bubble of the late-90s.

The trade, which I have advertised as the “Mystery Resource Stock/Nvidia”, is in the very early stages. It’s time to sell your tech darlings and buy beaten-down mining stocks. Most people can’t do this due to recency bias/FOMO/laziness/mental weakness. But we can and have.

How Are Our Names Reacting?

This is where we leave the free-riders behind and gleefully discuss our winners.